Some true words on the US economy and entitlement spending.

Tuesday, May 7th, 2013Some true words on the US economy and entitlement spending.

Tags: economy, incompetent, Obama economy, Politics, Video, Worst President Ever

Some true words on the US economy and entitlement spending.

Tags: economy, incompetent, Obama economy, Politics, Video, Worst President Ever

Here is collection of interesting items I put in my “blog about” file but didn’t get to.

Let’s lead off with some Blue on Blue media attacks. George Soros’ bought and paid for thugs at Media Matters attacked the uber-liberal reporters at NPR for committing an act of Journalism. Chana Joffe-Walt did a story on that covered the fraud and corruption in the federal disability program on Chicago’s Public Radio This American Life and National Public Radio’s (NPR) All Things Considered. Ms. Joffe-Walt apparently forgot about the memo that said that all news stories must praise our Dear Leader and blame Republicans.

Jon Stewart, a fairly reliable talking head for the extreme far hard left agenda, ripped in our Dear Leader for basic incompetence on his handling of the obscenely long backlog at the Veterans Administration. Gee, it’s almost as if Obama sees US military veterans as his enemy and is trying to kill them off.

Obamacare’s PR Problem: Not Just a Flesh Wound

Megan McCardle points out an annoying fact that leftists don’t like: The Aaron Sorkin Model of Political Discourse Doesn’t Actually Work

Democrat congressman Stephen Lynch on Benghazi Talking Points: ‘It Was Scrubbed … It Was False Information. There’s No Excuse For That.’ Yup, the Obama regime flat out lied the American people for the purpose of “damage control” prior to the election. This really does call for hearings.

Chicago Law Prof on Obama: “The Professors Hated Him because he was Lazy, Unqualified & Never Attended any of the Faculty Meetings” Hmmm…doesn’t sound like his work habits changed much.

Tags: Barack Obama, corruption, leftist hypocrisy, Liberal, liberal media bias, Politics, Worst President Ever

The GDP growth rate is out for Q1 2013, and at 2.5%, it is a nice improvement over Q4 2012’s 0.4% rate, which was revised up from the original estimate of -0.1%. It’s also lower than the 3% growth the Keynesian economists the Obama regime is strangely still paying attention to, predicted.

It’s not all good news for the worst recovery since the Great Depression, as this CNBC article points out.

A full percentage point of that 2.5% growth was a one time effect of the farming industry recovering from a drought. So the real growth rate was an anemic 1.5%

Household incomes also dropped at a 5.3 percent rate in the first quarter of 2013, and the saving rate – the percentage of disposable income households are socking away – fell to 2.6 percent, the lowest since the fourth quarter of 2007.

Neither of those last two items are a good sign for increases in consumer spending, which is going to get worse, as federal taxes go up, as well as local taxes. The tax burden will be worse in the so-called “Blue” states as their expensive social programs continue to overwhelm their budgets, and their revenue generating working classes flee for states with less oppressive taxes on anyone moderately successful.

The only bright point was that the official government inflation rate was only 0.9%. That is good for tax paying consumers, but is another missed milestone of the Obama Economic Team. They want at least 2%.

Tags: Barack Obama, economy, incompetent, Obama economy, Politics, Worst President Ever

The March unemployment numbers are out and the federal U3 number dropped from 7.7% in February to 7.6%. That should be good news, still over two points over what our Dear Leader promised us we would have if we passed his massive porkulus act, but still moving in the in right direction.

So why did the architect of the Obama economic plan, Austan Goolsbee, call the March unemployment numbers a “punch to the gut”?

To answer that,we need to look at some more numbers. Like the number of jobs the Federal BLS says were added in March, which is 88,000. Since you have been paying attention, you know that the US economy needs to generate at least 120,000 new jobs a month just to break even. So how did the U3 rate drop a tenth of a percent when we missed the break even point by over 33,000 jobs? The Federal Bureau of Labor Statistics calculates the U3 (and 5 other “U” rates) rate as a percentage of the labor force. While the BLS added 88,000 jobs, it dropped 630,000 workers from the labor force. That gives us a net loss of over a half million workers from the US economy in March 2013. Just what would the Federal BLS U3 number be if those 630,000 Americans were still counted in the labor force? One estimate has it at 11.7%. That is Carter era employment numbers. It shouldn’t be surprising that Obama’s Worst Recovery since the Great Depression is catching up with the Worst Recession since the Great Depression.

Not a shining moment for the Obama regime and it’s Keynesian economy policies. Not enough for them to give up on those failed policies though. For the left, their political agenda always trumps the truth.

Tags: Barack Obama, economy, incompetent, Obama economy, Politics, porkulus, unemployment, Worst President Ever, Worst Recession since the Great Depression

“Very few people know, for example, that the gap between black and white incomes narrowed during the Reagan administration and widened during the Obama administration. This was not because of Republican policies designed specifically for blacks, but because the free market policies create an economy in which all people can improve their economic situation.”

— Thomas Sowell

Tags: Barack Obama, economy, Obama economy, Politics, Quote of the Day, Ronald Reagan, Thomas Sowell

I was listening to a tech podcast where a couple of California were making fun of Texas Governor Rick Perry.

Let’s compare Texas under the leadership of Gov. Perry to California under Governor Moonbeam.

Let’s start with unemployment for January 2013

Texas: 6.3%

California: 9.8%

The federal U3 rate for January was 7.9%

So Texas was under the national rate by 1.3% while California was over the national rate by 1.9%

Take a look at job growth in Texas vs. California, and population shifts. The people California needs to pay its criminally high tax rates are leaving California. One of the more popular destinations of those fleeing Governor Moonbeam’s socialist paradise is Texas.

It’s clear that the tech reporters in question were laughing based on their leftist political bias, and not economic reality.

Tags: barking moonbat, California, economy, leftist hypocrisy, moonbat, Obama economy, Politics, taxes, Texas

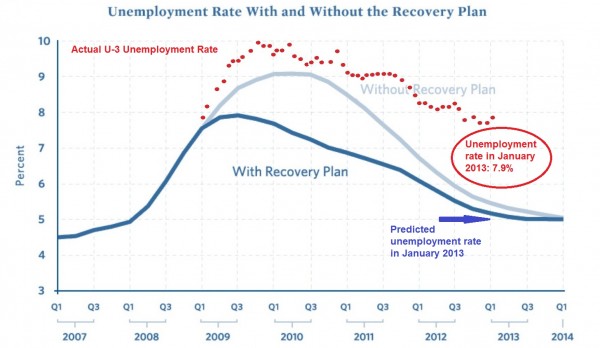

Let us once again refer the the chart our Dear Leader‘s economic team used to scare people into buying into the miserable failure of a porkulus package the democrats rammed down the throat of America back in 2009. Oh, but with reality also displayed.

So, using the Obama regime’s own metrics, the so-called “economic policy” has made things worse for average Americans than doing nothing would have done! They predicted an unemployment rate of 5.5% by now if nothing was done and 5.1% if the administration got to print more money and give it to democrat campaign donors.

The only reason the current U3 unemployment rate is is as low as 7.9% is that over eight million people have been removed from the labor pool that the feds use to calculate the employment rate. That includes everyone in the obscenely high long term unemployment pool that have run out of the extended unemployment benefits. The U6 rate, which includes the underemployed is still at 14.4%, which appears to be the “new normal” in Obama’s progressive dream of America.

James Pethokoukis points out that our Dear Leader‘s economic team made other really bad predictions.

…recall that back in January 2009 Team Obama economists Jared Bernstein and Christina Romer predicted the unemployment rate by 2013 would be closing in on 5%. (Of course, Obama’s economists also thought we’d be in a mini-boom of 4%-plus economic growth. That hasn’t happened either.)

In case you haven’t heard, GDP for the fourth quarter of 2012 came in at -0.1. That’s right, after three and half years of the worst recovery since the Great Depression, the US has slipped back into negative GDP growth under the stewardship of our Dear Leader. We actually could be in another recession, but we won’t know for another three months. Until then, we’re in a Schrödinger’s cat situation of recovery/recession.

Given that our Dear Leader and his democrat minions are calling for more taxes, more government spending (with $0.46 on the dollar borrowed) and more business hindering regulations, it’s looking more like that cat is a recession.

Tags: Barack Obama, culture of corruption, democrat, economy, incompetent, Obama economy, Politics, porkulus, unemployment, Worst President Ever

We’re $16+ trillion in debt, no federal budget in nearly four years, $1+ trillion deficits each of the last five years – and a president who says “We don’t have a spending problem.”

Tags: Barack Obama, democrat, economy, incompetent, Obama economy, Politics, quote, Quote of the Day, Worst President Ever

If I had a nickel for every time I heard a liberal place social issues above economic issues, I’d have enough money to pay off the monstrous $16.4 trillion and counting national debt.

Tags: economy, Obama economy, quote, Quote of the Day

First let us review some history and economic theory. Now you have heard often enough that the recent recession was the “worst since the Great Depression.” This bit of disinformation is repeated by those with a poor grasp or history and/or really don’t care if their information is accurate as long as it furthers their political agenda.

The worst recession “since the Great Depression” was clearly the recession American suffered through in the late 1970s. Double digit unemployment, double digit inflation and double digit interest rates! The prime rate actually hit 21%! So even if you had a job, the cost of living was rising faster and higher than you could possible get a raise and forget about buying a house with interest rates around 20%.

So we have that lie out of the way, let us get to some actual facts. The last recession end way back in mid 2009. That is when economy when from negative GDP growth to positive GDP growth. You may ask what growth? In most of America, there are still far too many empty store fronts as small business are shutting down faster than they are opening. What growth we have had has been anemic at best. GDP growth has not been over 2% in the three and half years since the last recession ended and employment has been over 7.5% and has even hit 10% during that time as well. What you are experiencing is clearly the worst recovery since the Great Depression.

Let’s review, worst recession followed by a roaring recovering in four years. Not the worst recession, worst recovery on record with no signs of getting better. Why such a glaring difference? Well the nice folks at Forbes covered this nicely. Let us review the facts about Reaganomics vs Obamanomics.

Reaganomics had four key points.

1. Cut tax rates to restore incentives for economic growth (just like JFK)

2. Real spending reductions, nearly 5% of the federal budget

3. Anti-inflation monetary policy

4. Deregulation, which saved American consumers an estimated $100 billion per year!

This simple plan resulted in the longest peacetime expansion in American history. The American standard of living increased by close to 20% and the poverty rate declined every year.

Now let’s look at Obama’s economic, and we are being generous here, plan. It is the exact opposite of President Reagan’s plan, which was clearly very successful. In addition to the new Obamacare taxes, he is calling for a sharp increase in the federal tax rate on the Americans who already pay the majority of the federal income tax. In additions, Obama is calling for increases in:

1. The capital gains tax

2. Corporate dividends tax

3. The Medicare tax

4. The death tax

Instead of spending cuts, Obama and the democrat controlled congress opened with nearly a trillion dollars in new federal spending, most of which was borrowed money, further increasing an already high federal debt.

Then we have the double-whammy of an inflationary monetary policy (the Quantative Easing non-stimulus acts) and massive re-regulation in health care, finance, energy and pretty much anything else Obama thinks he can get away with.

Mr. Ferrara sums up the results of the two policies nicely:

As a result, while the Reagan recovery averaged 7.1% economic growth over the first seven quarters, the Obama recovery has produced less than half that at 2.8%, with the last quarter at a dismal 1.8%. After seven quarters of the Reagan recovery, unemployment had fallen 3.3 percentage points from its peak to 7.5%, with only 18% unemployed long-term for 27 weeks or more. After seven quarters of the Obama recovery, unemployment has fallen only 1.3 percentage points from its peak, with a postwar record 45% long-term unemployed.

Previously the average recession since World War II lasted 10 months, with the longest at 16 months. Yet today, 40 months after the last recession started, unemployment is still 8.8%, with America suffering the longest period of unemployment that high since the Great Depression.

This is the Obama Economy. The worst recovery from a recession since the Great Depression. To make it worse, Obama’s policies are likely to cause that record to be broken, rather than produce real, sustainable economic growth.

Update: From Forbes: One Year Later, Another Look at Obamanomics vs. Reaganomics Here is the summary, it’s still Reagan for the win. Here are some of the highlights.

Let’s start with the GDP data. The comparison is striking. Under Reagan’s policies, the economy skyrocketed. Heck, the chart prepared by the Minneapolis Fed doesn’t even go high enough to show how well the economy performed during the 1980s.

Under Obama’s policies, by contrast, we’ve just barely gotten back to where we were when the recession began. Unlike past recessions, we haven’t enjoyed a strong bounce. And this means we haven’t recovered the output that was lost during the downturn.

This is a damning indictment of Obamanomics

…

Writing in today’s Wall Street Journal, former Senator Phil Gramm and budgetary expert Mike Solon compare the current recovery to the post-war average as well as to what happened under Reagan.

If in this “recovery” our economy had grown and generated jobs at the average rate achieved following the 10 previous postwar recessions, GDP per person would be $4,528 higher and 13.7 million more Americans would be working today. …President Ronald Reagan’s policies ignited a recovery so powerful that if it were being repeated today, real per capita GDP would be $5,694 higher than it is now—an extra $22,776 for a family of four. Some 16.9 million more Americans would have jobs.

…

…As I’ve written before, Obama is not responsible for the current downturn. Yes, he was a Senator and he was part of the bipartisan consensus for easy money, Fannie/Freddie subsidies, bailout-fueled moral hazard, and a playing field tilted in favor of debt, but his share of the blame wouldn’t even merit an asterisk.

My problem with Obama is that he hasn’t fixed any of the problems. Instead, he has kept in place all of the bad policies – and in some cases made them worse.

Tags: Barack Obama, culture of corruption, democrat, economy, incompetent, Obama economy, Politics, Worst President Ever