Thursday, March 21st, 2013

I was listening to a tech podcast where a couple of California were making fun of Texas Governor Rick Perry.

Let’s compare Texas under the leadership of Gov. Perry to California under Governor Moonbeam.

Let’s start with unemployment for January 2013

Texas: 6.3%

California: 9.8%

The federal U3 rate for January was 7.9%

So Texas was under the national rate by 1.3% while California was over the national rate by 1.9%

Take a look at job growth in Texas vs. California, and population shifts. The people California needs to pay its criminally high tax rates are leaving California. One of the more popular destinations of those fleeing Governor Moonbeam’s socialist paradise is Texas.

It’s clear that the tech reporters in question were laughing based on their leftist political bias, and not economic reality.

Tags: barking moonbat, California, economy, leftist hypocrisy, moonbat, Obama economy, Politics, taxes, Texas

Posted in Barking Moonbats, Obama Economy, Politics | No Comments »

Saturday, February 2nd, 2013

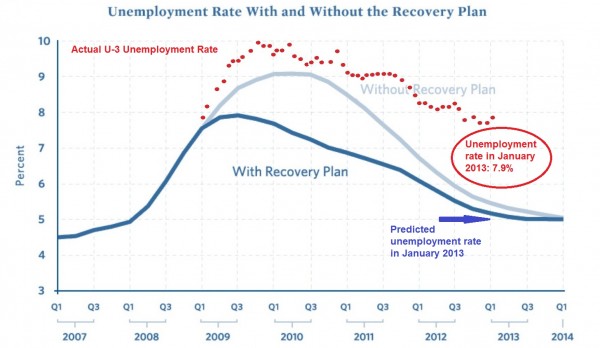

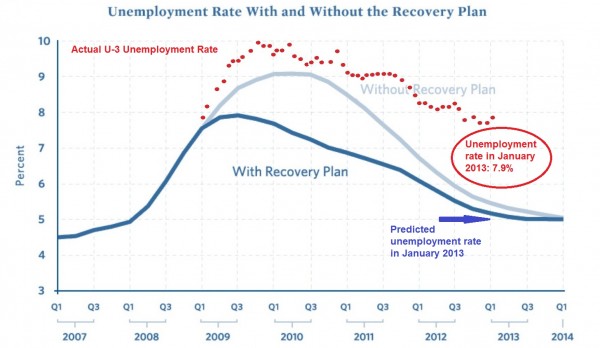

Let us once again refer the the chart our Dear Leader‘s economic team used to scare people into buying into the miserable failure of a porkulus package the democrats rammed down the throat of America back in 2009. Oh, but with reality also displayed.

So, using the Obama regime’s own metrics, the so-called “economic policy” has made things worse for average Americans than doing nothing would have done! They predicted an unemployment rate of 5.5% by now if nothing was done and 5.1% if the administration got to print more money and give it to democrat campaign donors.

The only reason the current U3 unemployment rate is is as low as 7.9% is that over eight million people have been removed from the labor pool that the feds use to calculate the employment rate. That includes everyone in the obscenely high long term unemployment pool that have run out of the extended unemployment benefits. The U6 rate, which includes the underemployed is still at 14.4%, which appears to be the “new normal” in Obama’s progressive dream of America.

James Pethokoukis points out that our Dear Leader‘s economic team made other really bad predictions.

…recall that back in January 2009 Team Obama economists Jared Bernstein and Christina Romer predicted the unemployment rate by 2013 would be closing in on 5%. (Of course, Obama’s economists also thought we’d be in a mini-boom of 4%-plus economic growth. That hasn’t happened either.)

In case you haven’t heard, GDP for the fourth quarter of 2012 came in at -0.1. That’s right, after three and half years of the worst recovery since the Great Depression, the US has slipped back into negative GDP growth under the stewardship of our Dear Leader. We actually could be in another recession, but we won’t know for another three months. Until then, we’re in a Schrödinger’s cat situation of recovery/recession.

Given that our Dear Leader and his democrat minions are calling for more taxes, more government spending (with $0.46 on the dollar borrowed) and more business hindering regulations, it’s looking more like that cat is a recession.

Tags: Barack Obama, culture of corruption, democrat, economy, incompetent, Obama economy, Politics, porkulus, unemployment, Worst President Ever

Posted in economy, Obama Economy, Our Dear Leader, Politics | 2 Comments »

Tuesday, January 15th, 2013

We’re $16+ trillion in debt, no federal budget in nearly four years, $1+ trillion deficits each of the last five years – and a president who says “We don’t have a spending problem.”

— Seton Motley

Tags: Barack Obama, democrat, economy, incompetent, Obama economy, Politics, quote, Quote of the Day, Worst President Ever

Posted in economy, Obama Economy, Politics | No Comments »

Wednesday, January 2nd, 2013

If I had a nickel for every time I heard a liberal place social issues above economic issues, I’d have enough money to pay off the monstrous $16.4 trillion and counting national debt.

Tags: economy, Obama economy, quote, Quote of the Day

Posted in Barking Moonbats, economy, Obama Economy, Politics | No Comments »

Monday, December 31st, 2012

First let us review some history and economic theory. Now you have heard often enough that the recent recession was the “worst since the Great Depression.” This bit of disinformation is repeated by those with a poor grasp or history and/or really don’t care if their information is accurate as long as it furthers their political agenda.

The worst recession “since the Great Depression” was clearly the recession American suffered through in the late 1970s. Double digit unemployment, double digit inflation and double digit interest rates! The prime rate actually hit 21%! So even if you had a job, the cost of living was rising faster and higher than you could possible get a raise and forget about buying a house with interest rates around 20%.

So we have that lie out of the way, let us get to some actual facts. The last recession end way back in mid 2009. That is when economy when from negative GDP growth to positive GDP growth. You may ask what growth? In most of America, there are still far too many empty store fronts as small business are shutting down faster than they are opening. What growth we have had has been anemic at best. GDP growth has not been over 2% in the three and half years since the last recession ended and employment has been over 7.5% and has even hit 10% during that time as well. What you are experiencing is clearly the worst recovery since the Great Depression.

Let’s review, worst recession followed by a roaring recovering in four years. Not the worst recession, worst recovery on record with no signs of getting better. Why such a glaring difference? Well the nice folks at Forbes covered this nicely. Let us review the facts about Reaganomics vs Obamanomics.

Reaganomics had four key points.

1. Cut tax rates to restore incentives for economic growth (just like JFK)

2. Real spending reductions, nearly 5% of the federal budget

3. Anti-inflation monetary policy

4. Deregulation, which saved American consumers an estimated $100 billion per year!

This simple plan resulted in the longest peacetime expansion in American history. The American standard of living increased by close to 20% and the poverty rate declined every year.

Now let’s look at Obama’s economic, and we are being generous here, plan. It is the exact opposite of President Reagan’s plan, which was clearly very successful. In addition to the new Obamacare taxes, he is calling for a sharp increase in the federal tax rate on the Americans who already pay the majority of the federal income tax. In additions, Obama is calling for increases in:

1. The capital gains tax

2. Corporate dividends tax

3. The Medicare tax

4. The death tax

Instead of spending cuts, Obama and the democrat controlled congress opened with nearly a trillion dollars in new federal spending, most of which was borrowed money, further increasing an already high federal debt.

Then we have the double-whammy of an inflationary monetary policy (the Quantative Easing non-stimulus acts) and massive re-regulation in health care, finance, energy and pretty much anything else Obama thinks he can get away with.

Mr. Ferrara sums up the results of the two policies nicely:

As a result, while the Reagan recovery averaged 7.1% economic growth over the first seven quarters, the Obama recovery has produced less than half that at 2.8%, with the last quarter at a dismal 1.8%. After seven quarters of the Reagan recovery, unemployment had fallen 3.3 percentage points from its peak to 7.5%, with only 18% unemployed long-term for 27 weeks or more. After seven quarters of the Obama recovery, unemployment has fallen only 1.3 percentage points from its peak, with a postwar record 45% long-term unemployed.

Previously the average recession since World War II lasted 10 months, with the longest at 16 months. Yet today, 40 months after the last recession started, unemployment is still 8.8%, with America suffering the longest period of unemployment that high since the Great Depression.

This is the Obama Economy. The worst recovery from a recession since the Great Depression. To make it worse, Obama’s policies are likely to cause that record to be broken, rather than produce real, sustainable economic growth.

Update: From Forbes: One Year Later, Another Look at Obamanomics vs. Reaganomics Here is the summary, it’s still Reagan for the win. Here are some of the highlights.

Let’s start with the GDP data. The comparison is striking. Under Reagan’s policies, the economy skyrocketed. Heck, the chart prepared by the Minneapolis Fed doesn’t even go high enough to show how well the economy performed during the 1980s.

Under Obama’s policies, by contrast, we’ve just barely gotten back to where we were when the recession began. Unlike past recessions, we haven’t enjoyed a strong bounce. And this means we haven’t recovered the output that was lost during the downturn.

This is a damning indictment of Obamanomics

…

Writing in today’s Wall Street Journal, former Senator Phil Gramm and budgetary expert Mike Solon compare the current recovery to the post-war average as well as to what happened under Reagan.

If in this “recovery” our economy had grown and generated jobs at the average rate achieved following the 10 previous postwar recessions, GDP per person would be $4,528 higher and 13.7 million more Americans would be working today. …President Ronald Reagan’s policies ignited a recovery so powerful that if it were being repeated today, real per capita GDP would be $5,694 higher than it is now—an extra $22,776 for a family of four. Some 16.9 million more Americans would have jobs.

…

…As I’ve written before, Obama is not responsible for the current downturn. Yes, he was a Senator and he was part of the bipartisan consensus for easy money, Fannie/Freddie subsidies, bailout-fueled moral hazard, and a playing field tilted in favor of debt, but his share of the blame wouldn’t even merit an asterisk.

My problem with Obama is that he hasn’t fixed any of the problems. Instead, he has kept in place all of the bad policies – and in some cases made them worse.

Tags: Barack Obama, culture of corruption, democrat, economy, incompetent, Obama economy, Politics, Worst President Ever

Posted in American History, economy, Obama Economy, Our Dear Leader, Politics, Taxes | 7 Comments »

Thursday, December 27th, 2012

The tv talking heads are all aflutter about Obama “cutting his vacation short” to “address the fiscal cliff”.

Give me a break. They had 2 years to deal with this. They might as well say “Obama heroically crams for test”.

– Andy at AoSHQ

Tags: Barack Obama, democrat, economy, incompetent, liberal media bias, Obama economy, Politics, Worst President Ever

Posted in economy, Obama Economy, Our Dear Leader, Politics | No Comments »

Wednesday, December 26th, 2012

Yes, math is required, you should have paid more attention in school.

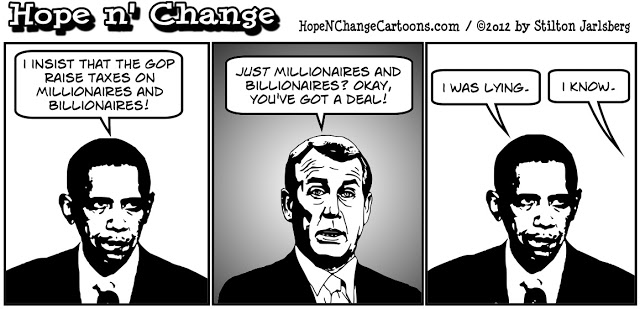

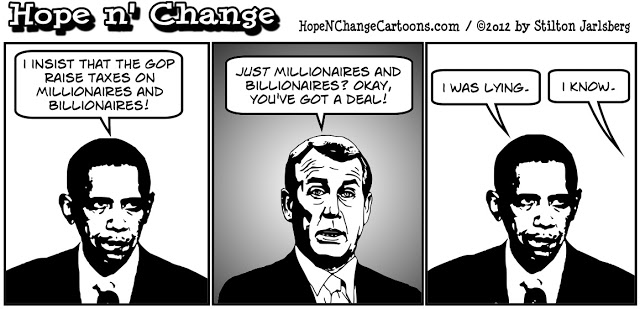

First, a spot on quick review of the so-called “Fiscal Cliff” negotiations.

Here is the bottom line kids, our Dear Leader has no issues with going over that cliff. Really, Barry doesn’t see any downside to it. He knows that tax hikes, even limited ones, are going to have a negative effect on the economy. The across the board tax hikes on top of new Obamacare taxes are going to be even worse. This way he can blame the Republicans, and the democrats with press credentials will back him on this, and then take credit for the budget cuts.

On to the math part, courtesy of johngalt at Flopping Aces.

One of the persistent myths that left repeats is that tax cuts don’t pay for themselves. This is one of those talking points that sounds simple, but is clearly false when you do the math.

As JG points out:

Given the period from 1994 to 1999, the growth period under Clinton, federal revenues increased by 1.3% for every 1% increase in GDP.

Given the period from 2003-2007, the growth period under Bush, with the lower tax rates, federal revenues increased by 1.7% for every 1% increase in GDP.

Pretty simple. Lower taxes results in an increase in GDP, which results in an increase in federal tax revenues. Note that most leftists will deny this and attack you personally for daring to bring actual math into the argument.

Let’s run with these numbers:

Applying those percentages in a comparison model, then, we can see that if given a starting point of $2.5 Trillion in revenues, and a growth of 3%(real GDP growth) in GDP, that under the Clinton tax rates, the following year’s revenues would equal roughly $2.598 Trillion. Under the Bush tax rates, that figure goes up to $2.628 Trillion. For a ten year period, the difference in revenue, assuming constant growth in GDP, becomes roughly $2.2 Trillion dollars difference in revenue

Now 2.2 Trillion dollars is about half of what our Dear Leader added to the federal debt in his first term. If Barry really was worried about the increasing federal debt and the stagnant economy, he would be working really, really hard to avoid across the board tax hikes. What is interesting, and not surprising to anyone who has been paying attention, is that Barry clearly isn’t interested in reducing the Federal debt, or improving the economy.

Some people out there in the MSM/DNC actually do the math and understand the problem. It is a very small subset of the MSM, which includes the nice folks over at CNBC. CNBC anchor Maria Bartiromo interviewed democrat Senator Ben Cardin recently, and called him out on the democrat’s political posturing.

“That’s all you want to do. That’s it. It’s your way or the highway. Raise the rates on the rich. No other way. Your way or the highway. That’s it. That’s where we are. Thank you, Senator.”

“So how come you’re not moving forward? What’s the problem? Because the American people are so tired of this, and they are really tired of the lawmakers thinking that the American people are stupid. You can’t keep coming on the show every week saying the same thing: ‘It’s not a balanced approach.’”

“You’re talking about $1.2 trillion in revenue, but you’re not prepared to put anything on the table. People are not stupid!”

The best part was that after she committed this act of actual journalism, traders on the floor watching erupted in cheers and applause. They do the math and know what is going on.

Tags: Barack Obama, democrat, economy, incompetent, leftist hypocrisy, Obama economy, political cartoon, Politics, Worst President Ever

Posted in economy, Obama Economy, Our Dear Leader, Politics, Taxes | No Comments »

Saturday, November 17th, 2012

“…nobody’s worried about being overrun by Mexicans anymore, because what Obama’s doing to the U.S. economy will do more to stanch immigration from Mexico than any border fence.”

— Prof. Glenn Reynolds

Tags: Barack Obama, democrat, economy, Glenn Reynolds, Obama economy, Politics, quote, Quote of the Day, Worst President Ever

Posted in economy, Obama Economy, Our Dear Leader, Politics | No Comments »

Wednesday, November 14th, 2012

Congratulations moonbats. You managed to get your socialist leader reelected despite 7.9% unemployment (which is only that low because the active workforce measured by the feds has shrunk dramatically during our Dear Leader‘s first term), record long term unemployment, and anemic economic growth (a 2% GDP growth rate has been the growth ceiling and GDP growth rate has consistently been lower than the inflation rate).

I won’t go into how Obama managed to drag out a win against someone with an actual record of success. Plenty of posts out there covering that subject.

Let’s just look at the affect of the news of a second Obama term has had and will most likely have.

First there is the Wall Street reaction. Remember that Barry was the Wall Street Golden Boy back in 08, receiving record high donations from the Big Money folks. The day after the election results were known, the DOW dropped over 300 points and has shown no signs of recovery.

Now the democrat operatives with press credentials will try to tell you that the stock market plunge had nothing to do with the election results, and is purely a reaction to the looming “fiscal cliff.” Yes, they really do think you are that stupid. The on coming “fiscal cliff” has been known about for months. If it really didn’t matter who was going to occupy the White House come January 20, 2013, the market would have tanked prior to the election. Instead, while there was still a chance that someone who understands actual economic reality and was not addicted to Keynesian fantasy, would win on November 6, 2012, the market chugged along fine, maintaining a DOW of about 13000. Ignoring the timing of the 300+ point drop would be like ignoring the Simpson DNA. It requires believing in ideology more than the objective evidence of actual facts.

Besides watching the value of your 401K drop (OK, there are a lot of moonbats who don’t have a retirement plan other than depending on the government, but there are some who actually participate in the economy in ways other than being a leech), you may have noticed the round of layoff announcements that started cropping up on November 7, 2012. Boeing being one of the larger ones. Don’t worry kids, plenty more of those on the way. While there will be plenty of white collar layoffs, there is plenty of pain in store for those part time workers at the lower end of the economic scale. Even if a company that employs large numbers of part time employees can actually stay in business given the crippling costs of Obamacare, they will almost certainly capping the number of hours a single employee can work. They have to do that in order to avoid being penalized even more by the job killing, economy crippling, federal nightmare known as Obamacare. Why do you think all those Unions, which supported our Dear Leader, asked for and received exemptions from have to be subject to Obamacare?

Short term, unemployment is going to kick back up over 8% and will continue to rise (unless the fed reduces the size of the workforce they count even more drastically than they already have). For the next two years, 8% unemployment (with the U6 rating being in the 14%-16% range) will be the best you can hope for. The odds of GDP growth rate breaking though a 2% ceiling also run slim to none.

As a wise man cautioned me in my youth, “Be careful of what you wish for. You may get it.” Well moonbats, you got your wish of a socialist utopia. Welcome to it.

Oh ya, the only thing that could possibly make our Dear Leader‘s economic policies look good will be the results of his foreign policy. That is a topic for another day, though.

Tags: 2012 election, Barack Obama, democrat, incompetent, Obama economy, Politics, Worst President Ever

Posted in Barking Moonbats, Obama Economy, Our Dear Leader, Politics | No Comments »

Tuesday, October 2nd, 2012

“An utterly insane number of Democrats think the economy is hunky-dory, not because it actually is, but because it simply has to be for their other silly beliefs to hold true. As a result, only 15% of Democrats reported that they’re hearing mostly bad things about the economy.”

Gabriel Malor

Tags: economy, Obama economy, Politics, quote, Quote of the Day

Posted in Barking Moonbats, Obama Economy, Politics | No Comments »