Friday, September 28th, 2012

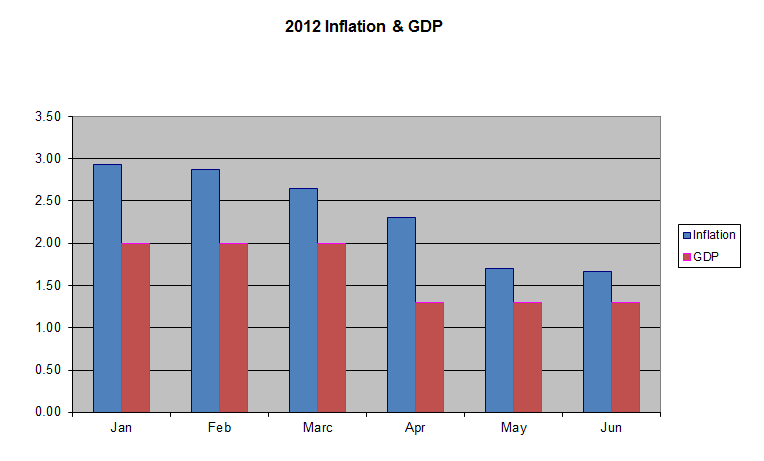

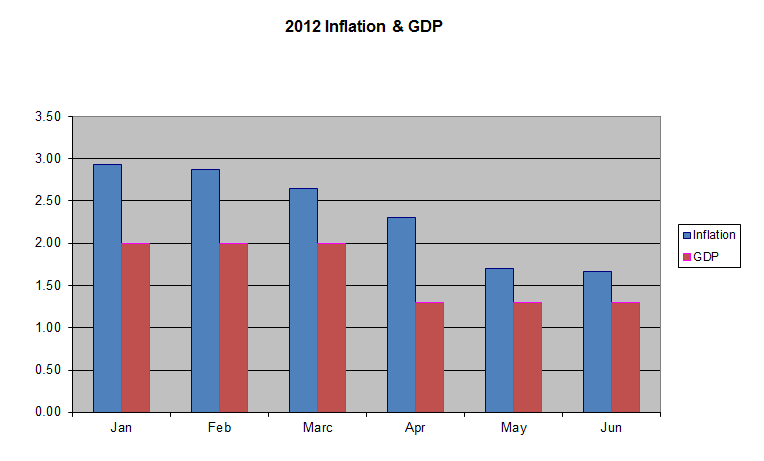

Back in early August, I posted a chart that compared the GDP growth rate of inflation.

It showed that the GDP was growing slower than the rate of inflation, or to put it more simply, the money you have is losing value faster than the economy is growing.

It’s time for an updated version of that chart, since the Fed just reduced the GDP rate for Q2 2012 to 1.3%, not the 1.5% they projected back in early August.

As you can see, the economy under our Dear Leader’s regime is clearly going in the wrong direction.

Tags: Barack Obama, democrat, economy, incompetent, inflation, Obama economy, one-term President, Politics, Worst President Ever

Posted in economy, Obama Economy, Our Dear Leader, Politics | 1 Comment »

Sunday, October 2nd, 2011

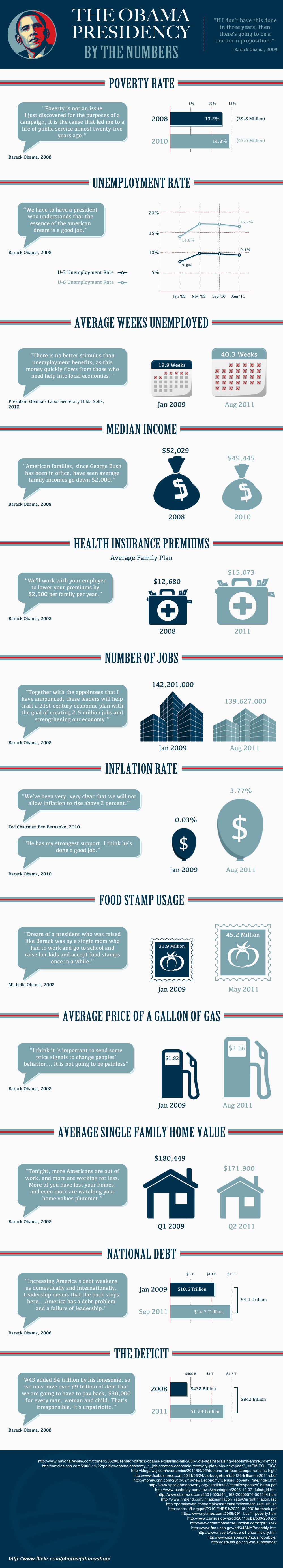

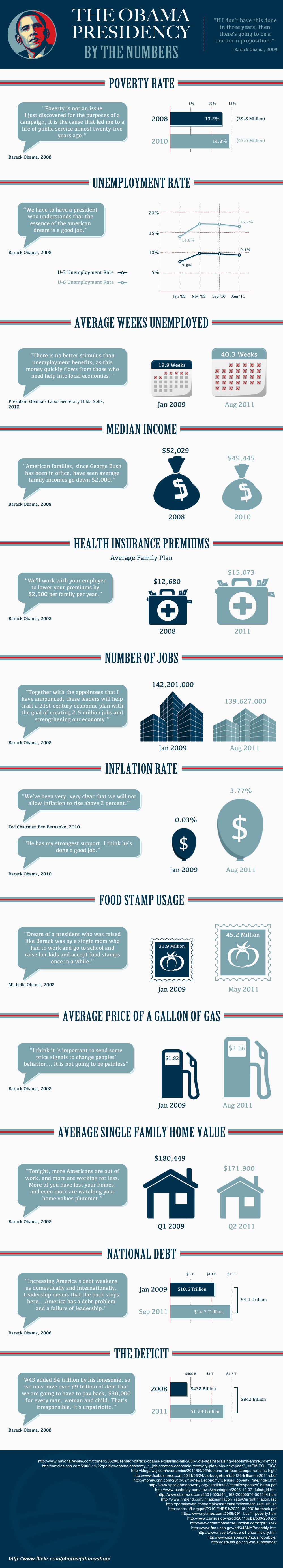

Found these hard cold facts over at AoSHQ.

Tags: Barack Obama, democrat, economy, incompetent, inflation, one-term President, Politics, unemployment, Worst President Ever

Posted in economy, Obama Economy, Our Dear Leader, Politics | No Comments »

Saturday, June 11th, 2011

Not a surprise to anyone who has taken a graduate level economics class and pays attention, but since that is probably a small slice of the population, let’s review.

The Obama administration’s monetary policies have added approximately 56.5 cents to the price of every gallon of gas you pump, according to a report by members of the congressional Joint Economic Committee.

Estimates suggest that had the dollar maintained the value it had when Obama came into office, gasoline would cost approximately $3.40 per gallon instead of around $4 per gallon in many parts of the country.

Here is the short form for those who haven’t studied macro economics. Oil is traded on the open market with the US dollar being the standard currency used for for that commodity. Our Dear Leader’s monetary policy of just printing money to pay for his massive spending increases ( the so-called “quantitative easing” programs are good examples of this) has caused inflation, which means the US Dollar has less value than it did before. To make this even simpler, things cost more when you buy things using US dollars. Not because the value of the item being purchased has gone up. It is because the amount of goods and services a US Dollar can be traded for has gone down. This includes crude oil. Your dollar is worth less, so you pay more dollars for things like gasoline, a crude oil product.

Fed Chairman Ben Bernanke claimed this printing money scheme would actually “grow the economy.” Fed Chairmen Paul Volcker and Alan Greenspan disagreed, stating that the Obama/Bernake plan would weaken US currency and result in inflation.

Clearly, Volcker and Greenspan were right, and Obama and Bernanke were wrong.

The Obama administration is calling for another round of “”quantitative easing” in spite of the clear and obvious facts of the matter.

Tags: Barack Obama, democrat, economy, incompetent, inflation, Obama economy, one-term President, Politics, Worst President Ever

Posted in energy, Obama Economy, Our Dear Leader, Politics | 1 Comment »